10/25/10

Jon Stewart gets to the bottom of this foreclosure mess!

Foreclosures gone wild...the trilogy.

Foreclosures Gone Wild 1

Foreclosures Gone Wild 2

Foreclosures Gone Wild 3

9/20/10

U.S. Home Prices Face 3-Year Drop as Inventory Surge Looms - Bloomberg

The slide in U.S. home prices may have another three years to go as sellers add as many as 12 million more properties to the market…

“Whether it’s the sidelined, shadow or current inventory, the issue is there’s more supply than demand,” said Oliver Chang, a U.S. housing strategist with Morgan Stanley in San Francisco. “Once you reach a bottom, it will take three or four years for prices to begin to rise 1 or 2 percent a year.”…

Fannie Mae Forecast

Fannie Mae, the largest U.S. mortgage finance company, today lowered its forecast for home sales this year, projecting a 7 percent decline from 2009. A drop in demand after the April 30 tax credit expiration “suggests weakening home prices” in the third quarter, according to Fannie Mae…

8 Million

Douglas Duncan, chief economist for Washington-based Fannie Mae, said in a Bloomberg Radio interview last week that 7 million U.S. homes are vacant or in the foreclosure process. Morgan Stanley’s Chang said the number of bank-owned and foreclosure-bound homes that have yet to hit the market is closer to 8 million…

In addition to the as many as 8 million properties vacant or in foreclosure, owners of another 3.8 million homes -- 5 percent of U.S. households -- said they are “very likely” to put their properties on the market within six months if there is improvement, according to a survey</a> by Seattle-based Zillow.

“This has the potential to create a sawtooth pattern along the bottom,” Stan Humphries, Zillow’s chief economist, said in a telephone interview. “Homes begin to sell and a few sidelined sellers rush into the marketplace and flood the marketplace.” …

The Obama administration’s effort to help mortgage holders, HAMP, is another source of future inventory as owners with new loan terms re- default, Ritholtz said. About half of the modifications done in 2009 were behind in payments by the first quarter of 2010, according to the Treasury Department…

Read the full article by clicking the link below…(if you dare)

U.S. Home Prices Face 3-Year Drop as Inventory Surge Looms - Bloomberg

9/16/10

WHY IS THE BANK FORECLOSING IF I AM DOING A SHORT SALE (OR LOAN MODIFICATION)?

A local attorney who counsels many of our clients, Richard Zaretsky, has just posted this excellent article on his blog. It answers the very common, but perplexing question posed above.

Do We All Have A Common Goal? Do all short sellers cooperate with the short sale process? The answer is a resounding NO. The short seller is typically living in the house "for free" and is not all that interested in moving out and paying rent. Therefore, short sellers are notoriously delay oriented. Banks believe this to be a fact.

I Want To Stay! Loan Modification borrowers are in a somewhat different boat. They don't have any plan to move out of the house as they want to modify the loan to something more affordable.

They Want WHAT!?!@? Short Sellers and Loan Modification borrowers have something in common - they have to accept the lender's terms of the short sale or loan modification or face loss of the home through foreclosure. The alternative of the loss of the house in foreclosure is usually not an desirable option. The lender can never be sure that (a) the buyer in a short sale is not going to walk away from the sale at the last minute, (b) the seller will accept the demands the lender conditions the short sale approval upon, or (c) the borrower will accept the loan modification terms offered by the lender (if any are offered at all).

Hurry Up and Wait? So knowing or believing all the above, if you were the lender and you knew that from start to finish the mortgage foreclosure process was going to take 300 to 700 days and the short sale or modification may or may not end up successful, would you wait 3 or 5 months for a short sale contract or for the borrower to submit complete loan modification information - BEFORE you started the clock on the foreclosure process? OF COURSE NOT! Therefore, even if you have a good faith intention to proceed with a short sale or loan modification, the lender will NOT stop a pending suit or delay filing an otherwise ripe suit for foreclosure. The result is one hand of the lender pursues solutions with the borrower and the other hand of the lender pursues solutions against the borrower - all at the same time.

Remind Me To Stop Before I Drive Off the Cliff! Even the HAFA and HAMP programs have guidelines for participating lenders that state that the lender will not have to stop the foreclosure process - but only that if a borrower is accepted into the processing of under HAFA or HAMP, the lender will not actually have the foreclosure sale! But they can go all the way to getting a foreclosure sale date set!

So if you are trying a short sale or modification, don't be surprised when the Sheriff rings your doorbell at 6 a.m. with a subpoena and summons and complaint for foreclosure even though the nice people at the bank are helping you in your "solution". If you are 90 days or more late (typically), you should expect that visit and introduction to your foreclosure complaint very very soon. And once you get served BE SURE TO IMMEDIATELY CONTACT YOUR ATTORNEY TO DISCUSS THE FORECLOSURE AND WHAT SHOULD BE DONE ABOUT IT.

Read Richards entire article here: WHY IS THE BANK FORECLOSING IF I AM DOING A SHORT SALE (OR LOAN MODIFICATION)?

9/14/10

Freddie Mac estimates home sales to fall another 23% in 3Q

Below are a few of today’s housing industry headlines:

- Freddie Mac expects 4 million new and existing home sales in the third quarter, a possible 20.7% decline from last year and 23% drop from the previous quarter.

- Kondaur (distressed note buyer) chief executive Jon Daurio joined Moody's Investors Service analysts saying he expects prices to fall another 20%…Daurio said he expects the drop to occur over the next three years.

You can read the article here: Freddie Mac estimates home sales to fall another 23% in 3Q « HousingWire

9/10/10

Thinking about pursuing a loan modification? In the middle of a loan modification negotiation? Read this...

I have seen too many borrowers taken advantage of when attempting to negotiate a forebearance or loan mod without professional and legal assistance. The banks are no better than low-life debt collectors that will say anything to get some more money out of someone. But now, people have had enough and it is getting some national press...consumers are suing the banks for not following through on loan mod committments.

Read the full article from today's USA today HERE

If you have ANY questions regarding your loan, please give me a call. I promise that if I don't know the answer or solution right away, I will find out or point you in the direction of the person who does know. My direct line is 561-602-1258.

Thanks for reading

9/9/10

FDLE Florida Sexual Offenders Search

You can search for sexual predators by zip code via the link below:

FDLE Florida Sexual Offenders and Predators - Offender Search

8/24/10

Experts and news outlets surprised: Home sales plunge!

But if you read this blog…YOU shouldn’t have been surprised at all. I have been counseling my sellers for many months now…you want to be the NEXT home to sell!

Here are some snippets from some of today's press releases:

1) Sales of previously occupied homes plunged last month to the lowest level in 15 years, despite the lowest mortgage rates in decades and bargain prices in many areas.

July's sales fell by more than 27 percent to a seasonally adjusted annual rate of 3.83 million, the National Association of Realtors said Tuesday. It was the largest monthly drop on records dating back to 1968, and sharp declines were recorded in all regions of the country.

2) With home sales plunging to their lowest level in 15 years, economists warn that a double-dip in housing prices is just around the corner, threatening to further slow the overall recovery.

Existing home sales sank 27.2% in July, twice as much as analysts expected, to a seasonally adjusted annual rate of 3.83 million units. Much of that drop is attributed to the end of the $8,000 homebuyer tax credit. Sales of single-family homes, which account for a bulk of the transactions, are at the lowest level since May 1995.

Inventory has also continued to climb, rising 2.5% to 3.98 million existing homes for sale. That represents a 12.5-month supply at the current sales pace, the highest since October 1982 when it stood at 13.8 months. A six-month of supply is considered normal.

Chart of existing home sales…watch out for that falling knife!

"....Purchases of existing homes plunged 27.2 percent to a 3.83 million...Estimates in the Bloomberg survey of 74 economists ranged from 3.96 million to 5.3 million..." Good job experts

Still want to listen to the ‘experts’?

If you are even thinking that you may want/need to sell anytime in the near and not-so-near future…please give me a call so we can have a lively discussion regarding my recommendations. My direct line is 561-602-1258

Thanks for reading,

Steve

8/5/10

Foreclosures in Lakeview Estates...as of 8/4/10

Now, just because I report them as "foreclosures" does not mean that they are owned by the bank and are for sale for pennies on the dollar....at least not yet. What it means is that these homes have a Lis Pendens filed on them. From Nolo Law Dictionary: Lis Pendens: Latin for "a suit pending." A written notice that a lawsuit has been filed concerning real estate, involving either the title to the property or a claimed ownership interest in it.

There are currently 9 Lakeview Estates homes reported to be in foreclosure as of today. A few of the ones on this list have already been taken back by the bank at the courthouse sale. Below I will report them by street, alphabetically.

- Blue Bay - 3

- Brickyard - 2

- Hudson Bay - 1

- Turtle Point - 1

- Windy Preserve - 2

7/23/10

Inflation? Deflation?

It would seem that everyone is right...here is the best and easiest to explain/understand definition/comparison-contrast of inflation and deflation:

I've seen some quotes equating to deflation as the things you own, and inflation as the things you need. Close, but the real explanation is more like this:

Prices declines are occuring in goods/services sectors backed by debt resulting from contracting credit...things that you would normally use a loan/credit to buy (deflation). Price increases are occurring in goods/services sectors acquired with money resulting from increasing money supply (inflation), (things like food, utilities, gas for the car, etc ).

Ben can print money 'til the cows come home, showering every citizen with $10k, $100k, $1m per year/quarter/month. All that will happen is a direct escalation in prices of assets not backed by debt. Price increases for items backed by debt will not resume/recur until there is an underlying organic demand for credit and a corresponding easing in credit terms (inflation). That is, the so-called final (ie private) demand.

And there you have it...

7/15/10

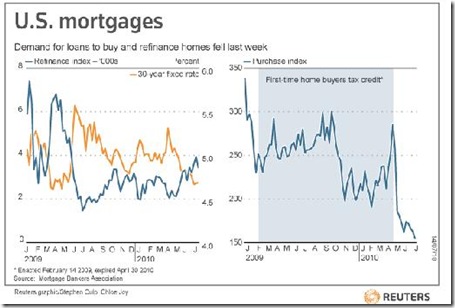

Mortgage applications at a 13 year low...so why is that important?

Take a look at this statistic and chart below: The refinance share of mortgage activity remained constant at 78.7 percent of total applications…so, at a 13 year low number, only 21% of the mortgage applications were for new purchases! On an unadjusted basis, the volume of purchase applications is 43% lower than the same week last year!

If even at sub-5% rates buyers are not interested, what’s going to happen to buying interest if (when) rates go up?

- Unemployed people do not buy homes.

- People who have had their hours or salary reduced 20-30% do not buy homes.

- People with a credit score of 599 or less (25% of the population) do not qualify to buy a home.

- People who lost 30% of their home equity can not sell their existing home to buy a new one.

If you’d like to discuss how this all affects your plans to sell or buy, please give me a call on my direct line at 561-602-1258.

Thanks for reading,

Steve Jackson

7/4/10

7/1/10

Disastrous home sales report - July 1, 2010

The experts expected home sales to drop once the homebuyer tax credit lapsed at the end of April, but the depth of the decrease was shocking (only to the “experts”).

According to the National Association of Realtors (NAR), pending home sales fell a whopping 30% in May. Their index, which measures signed sales contracts but not closed sales, plunged to 77.6 from 110.9 in April. It's even off 15.9% from a year ago when the nation was barely emerging from the recession.

The pending home sales report is a disaster," said Mike Larson, a real estate analyst for Weiss Research. "Sales fell off a cliff after the tax credit expired. It's the biggest monthly decline ever and the index is at its lowest level since NAR began tracking it in 2001."

(As expected)…Lawrence Yun, NAR's chief economist, downplayed the damage a bit. According to him, customers rushed into deals to claim the credit, borrowing from May sales. Once the economic recovery comes into full swing, housing markets will heat up. "If jobs come back as expected, the pace of home sales should pick up later this year," said Yun, "and reach a sustainable level of activity given very favorable affordability conditions."

The question is when -- or if -- the job market will ever bounce back.

"We're not creating jobs," said Larson. "The housing problems now are being driven by broad economic problems."

6/20/10

6/6/10

Lakeview Estates market activity recap...on-the-market, sold and under contract

- 6514 Blue Bay: Aspen, pool...Short Sale...Sold @ $250k

- 2 Short Sales

- 2 Foreclosure Sales

- 3 traditional sales

- Acupulco, pool @ $329k...53 days on the market

- Sanibel, lake, pool @ $385k...9 days on the market

- Riviera, lake @ $215...73 days on the market

- Antigua, pool @ $299k...229 days on the market

- A Palm Beach, lake, pool...asking price of $390k

Steve and Jackie Jackson

6/1/10

What is everyone searching for?

People will choose to rent for 2 main reasons...they can't buy a home or they don't want to buy a home.

A large number of people today who CAN'T buy fall into a two categories: 1) No job/job or income instability, 2) credit issues. Hopefully, the job situation will improve consistently going forward, but the number of people with credit issues will most likely continue to rise. Think about the statistic in this following chart: (look at the very left bar in the graph)

The state with the greatest percentage of people at least 30 days late on their mortgage is...FLORIDA! Over 1 out of every 4 people with a mortgage is 30 or more days behind.

It is common knowledge that missing mortgage payments will deliver a pretty significant hit to ones credit score. And with the abject failure of the Govt. HAMP (loan modification) program, it is a fairly safe bet that a large number of people currently behind on their mortgage will end up eventually either losing their home in a foreclosure action or successfully completing a short sale (the much better alternative). In either case, these folks will not be purchasing a homeduring the next 2 years, or more. These are ones who can't buy a home.

Then you have large segment who still believe that it is not a good time to buy..they are renters by choice, and their numbers are growing daily.

Now, I personally know that many investors are plowing money into the real estate market, although they are very selective and are making decisions that factor in NO appreciation for 5 or more years. And, there are still buyers out there. They are balancing the historically low interest rates, low home prices and reduced competition against the chance that home values will decline further. But most of my buyers today have a long enough time horizon to give them the confidence that the combo of interest rate and home prices makes it a good time to buy.

Any homeowners reading this who are considering moving in the next 24 months or so should seriously consider getting your home on the market sooner, rather than later. Sell, get you money in the bank now, and rent for a while if you need to. It may be a bit inconvenient, but it appears that this may be the smartest move.

5/25/10

Foreclosures in Lakeview Estates

- 3 on Blue Bay

- 2 on Windy Preserve

- 2 on Brickyard

- 1 on Hudson Bay

- 1 on Turtle Point

5/13/10

Short Sale Myths

RISMEDIA, May 13, 2010—With short sales making up almost 35% of home sales in March and the country with a national foreclosure problem, I Short Sale, Inc., one of the largest short sale firms in the U.S., sets the record straight on common short sale myths.

1. You must be default on your mortgage to negotiate a short sale. Short sales are not a function of default status on a mortgage. They are the result of the bank mitigating a potential default situation that, in the long run, will cost more money to the investors. We have completed many short sales in instances when the borrower was not in a default situation.

2. Listing my home as a short sale is embarrassing. Anytime we get ourselves into a tough financial situation it can cause some embarrassing feelings. It is important to remember that those feelings will not help us get back onto stable financial ground. We need to overcome our feelings and do what is right to protect our financial futures.

3. Buyers aren't interested in short sale properties. Short Sale properties are often times available at a competitive price to other properties on the market. In many cases, short sale properties are very well cared for and have not had to endure the deferred maintenance of a REO property. Short Sale properties are in great demand in the marketplace.

4. There's not enough time to negotiate a short sale before foreclosure. A good negotiator takes into account the timeline affiliated with a foreclosure. There is always a chance that a short sale can be negotiated. However, the only way to know for sure is to try.

5. The bank would rather foreclose than complete a short sale. Banks do not want to foreclose on property. It is expensive and carries a high level of liability once the bank owns that property as an REO. Wherever possible, banks are seeking other loss mitigation options before foreclosure.

6. Short sales are impossible and never get approved. Short sales are complicated, but not impossible. We negotiate short sale approvals every day.

5/9/10

5/4/10

Lakeview Estates market activity

1) Paramount Palm Beach Plus 5, pool, lake - $365,000

Under Contract

1) Short Sale Aspen, pool - $299,000 asking price

2) Riviera, lake - $315,000 asking price

On The Market

1) Short Sale Riviera, lake - $305,000 asking

2) Antigua, pool - $329,900 asking

3) Acapulco, pool - $343,000 asking

4) Aspen plus 5, lake, pool - $384,999 asking

5) Palm Beach, lake, pool - $390,000 asking

4/23/10

CBS The Early Show...Rebecca Jarvis; Selecting a real estate agent

But, through lack of research or lack of expeirence she failed to give any concrete advice on how to judge if you are picking a good agent or a bad agent. The best advice is be diligent and careful when hiring an agent...you won't know you hired the wrong one until it is too late.

Personally, I have seen sellers select an agent because (in their own words) "they send me postcards all the time". Others have selected neighbors, friends, church associates etc. as their agent with no other qualifying criteria.

A recent development is the "mega agent" who advertises under their name but actually has less experienced "team members" handle just about all aspects of a transaction, all the time selling the client on how this is good for them. The "mega agent" doesn't meet with the client, doesn't write or negotiate the contracts, doesn't interact with the buyers agent and may not ever speak with the client...they are involved in the clients transaction in name only.

While this is just my opinion and there may be no way to prove this, I would argue that the best agents occupy the "80th to 90th percentile" of a Bell Curve of relative real estate production. I say this because my years in the business have led me to believe that the absolute "top" agents in terms of total # of homes sold tend to be focused primarily on SALES and SELF-PROMOTION and most of the actual work is delegated to other individuals, while the agents just below that tend to be more client-centric and personally involved in the clients transaction.

4/7/10

A rundown of the new HAFA initiative...

We have already received specialized, in depth training on this new program and will briefly summarize the features and benefits below:

Qualifying Factors

- Must be HAMP eligible

- Principal residence only (must be living there, with 1 allowable exception)

- 1st lien mortgage originated prior to 2009

- Mortgage balance less than $729,750

- Mortgage payment exceeds 31% of monthly gross income

- NOT a Fannie Mae or Freddie Mac backed loan

Here are the Fannie and Freddie loan look-up tools:

Fannie Mae Loan Lookup

Freddie Mac Loan Lookup

How is the HAFA program different or better than what is being done now?

The main problem, for both sellers and buyers, with traditional short sales was that they took too long and the process was wholly unpredictable. It was always difficult to keep buyers interested in, and committed to, the process. The HAFA program was designed to speed up and standardize the short sale process and give incentives for each short sale completed. During a non-HAFA short sale, there is no government incentive for banks to help you. Also, a VERY important benefit to homeowners is the requirement that participating lenders release you of any further libility for the deficiency amount!

What are the incentives?

- As a qualifying homeowner, you would be entitled to a $3000 "relocation" incentive payment at the time of closing and funding of your short sale.

- Servicers participating in the program will receive $1,500 for a completed short sale

- Investors (lenders) can receive up to $2,000 for payments made to junior lienholders

- Junior lienholders can receive up to $6000

Yes, but it won't cost you anything. Under HAFA, our fee will be deducted from the sale proceeds and paid by the lender. It is a requirement of a HAFA short sale that you work with a real estate professional throughout the HAFA short sale process. The Jackson Realty Group is now the areas HAFA specialists, having received the most up-to-date training available on the HAFA program.

Also, any time there is a new program announced, there are people who set up scams based upon the publics ignorance of the details, and the HAFA program will be no different. Other than an attorney you may hire to assist with a pending foreclosure or associated issue, beware of anyone requesting "up front fees" to assist you in processing a HAFA short sale. MakingHomeAffordable.gov (MHA) provides the following guidelines:

• Beware of anyone who asks you to pay a fee in exchange for counseling service or modification of a delinquent loan.

• Scam artists often target homeowners who are struggling to meet their mortgage commitment or anxious to sell their homes.

• Beware of people who pressure you to sign papers immediately, or who try to convince you that they can "save" your home if you sign paperwork or transfer over the deed to your house.

• Never make a mortgage payment to anyone other than your mortgage company without their approval.

• Do not sign over the deed to your property to any organization or individual unless you are working directly with your mortgage company to forgive your debt.

If you would like to meet with me to discuss if you may qualify for this program and to review the process as well as your options, please call me at 561-602-1258 or CLICK HERE and send me an email with your contact information.

4/4/10

4/1/10

Foreclosures in Lakeview Estates

3/16/10

Foreclosures: Housing defaults soar in Palm Beach County

click here to read the full story

3/6/10

Lakeview Estates market activity recap...on-the-market, sold and under contract

There is 1 property with a contract pending...it is an Aspen with a pool, Short Sale, last asking price of $299k.

There were 2 reported sales in the last three months:

1) Aspen - Corporate Relocation - $270,000

2) Aspen - Bank Owned - Pool - $233,000

Then there were 3 other homes that were on the market this year that did not sell but are no longer actively on the market.

2/28/10

CNN Money reports 25% home price decline ahead for our area!!

2/10/10

New credit card rules to take effect soon...H.R. 627

If you'd rather just see a brief summary... here you go:

Sec. 101. Prior notice of rate increases required. Prohibits increase in APR without 45 days= notice. Prohibits applying rate increases retroactively to existing balances. Requires clear notice of right to cancel credit card when APR is raised.

Sec. 102. Freeze on interest rate terms and fees on canceled cards. Prevents APR from being raised, or repayment terms being cancelled, if a cardholder cancels a card.

Sec. 103. Limits on fees and interest charges.

< Prohibits double cycle billing: Prohibits credit card issuers imposing interest charges on any portion of a balance that is paid by the due date.

< Over-the-limit fee restrictions: Cardholders must be given the option of having a fixed credit limit that cannot be exceeded, and card companies cannot charge overlimit fees on cardholders with fixed limits. Cardholders may elect to prohibit the creditor from completing overlimit transactions that will result in a fee or constitute a default under the credit agreement. Overlimit charges can only be charged when an extension of credit, rather than a fee or interest charge, causes the credit limit to be exceeded. Overlimit charges can only be applied once during a billing cycle.

< Prohibits charging interest on fees: Prohibits the charging of interest on credit card transaction fees, such as late fees and overlimit fees.

< Limits on charging certain fees: Prohibits credit card issuers from charging a fee to allow a credit card holder to pay a credit card debt, whether payment is by mail, telephone, electronic transfer, or otherwise. Requires fees to be reasonably related to cost. Foreign currency exchange fees may only be imposed in an account transaction if the fee reasonably reflects costs incurred by the creditor and the creditor publicly discloses its method for calculating the fee.

Sec. 104. Consumer right to reject card before notice is provided of open account. Gives cardholders who get preapproved the right to reject the card up until they activate it without having their credit adversely affected.

Sec. 105. Use of terms clarified. Prevents card companies from using the terms fixed rate and prime rate in a misleading way by establishing a single definition.

Sec. 106. Application of card payments. Prohibits credit card companies from setting early deadlines for credit card payments. Requires payments to be applied first to the credit card balance with the highest rate of interest, and to minimize finance charges. Prohibits late fees if the card issuer delayed crediting the payment. Prohibits card companies from charging late fees when a cardholder presents proof of mailing payment within 7 days of the due date.

Sec. 107. Length of billing period. Requires credit card statements to be mailed a least 21 days before the bill is due (current requirement is 14 days).

Sec. 108. Prohibition on universal default and unilateral changes to cardholder agreements. Prevents credit card issuers from increasing interest rates on cardholders in good standing for reasons unrelated to the cardholders behavior with respect to that card. Prevents credit card issuers from changing the terms of a credit card contract for the length of the card agreement. Allows penalty rate increases only for specific, material actions or omissions of the consumer specified in the card agreement. Requires issuers to lower penalty rates that have been imposed on a cardholder after 6 months if the cardholder commits no further violations.

Sec. 201. Payoff timing disclosures. Requires credit card issuers to provide individual consumer account information and to disclose the period of time it will take the cardholder to pay off the card balance if only minimum monthly payments are made. Also requires issuers to disclose the total amount of interest the cardholder will pay to pay off the card balance if only minimum monthly payments are made.

Sec. 202. Requirements relating to late payment deadlines and penalties. Requires full disclosure in billing statements of required payment due dates and applicable late payment penalties. Requires that cardholders be given a reasonable period to make payment. Requires that payment at local branches be credited same-day.

The above summary only details a small portion of what the bill regulates...if you have any credit cards (and who doesn't), it may pay to print out and read the entire bill.

I hope this is helpful to you.

2/3/10

The next chapter in the book entitled: The housing crisis..what they DON'T want you to know!

Thanks...Steve Jackson

Lakeview Estates, Lake Worth Florida...foreclosure tracker

As of 4/1/10 there are 7 Lakeview Estates homes in some stage of foreclosure.