I just read this analysis on one of my favorite blogs: ZeroHedge.com;

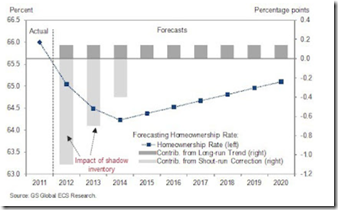

“the just released March Case Shiller data puts this latest speculation very much in doubt (once again), following a miss of consensus expectations in the Top 20 Composite of a 0.20% increase, printing at half that, or 0.09%, and more importantly, a decline from the February rate of increase, which was 0.15%. The non-seasonally adjusted number declined by 0.03%, the 7th consecutive drop in a row. All this begs the question: did housing just quadruple dip, with a February local extreme in the Sequential rate of change. As the chart below shows, we had comparable peaks in the summer of 2009, in April 2010, and again in April 2011, following which the downward slide resumed every single time once the temporary benefits of monetary and fiscal easing subsided. Also, recall that March was the last month receiving benefits of a record warm winter: in effect a mini demand pull program. And now comes the hangover. Bottom line: based on a broad index, housing is about to decline once again, and make a total joke out of all those who, yet again, made "bold" annual housing bottom predictions…

This from the actual Case-Shiller report:

“While there has been improvement in some regions, housing prices have not turned,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “This month’s report saw all three composites and five cities hit new lows. However, with last month’s report nine cities hit new lows. Further, about half as many cities, seven, experienced falling prices this month compared to 16 last time.

The S&P/Case-Shiller index of property values fell 2.6 percent from a year earlier after a 3.5 percent drop in February, the group reported today in New York. The decline matched the median forecast of economists surveyed by Bloomberg News. The index rose from the prior month on a seasonally adjusted basis.

Take a look at the chart below that I marked-up. It seems to me that the media/industry groups have started calling the summer selling pattern a “recovery”. That being said…if you have equity in your home and are thinking about selling, this summer season (June/July/August) may be a good time to jump in.

Thanks for reading…Steve Jackson

Call me directly at 561.602.1258