It would seem that everyone is right...here is the best and easiest to explain/understand definition/comparison-contrast of inflation and deflation:

I've seen some quotes equating to deflation as the things you own, and inflation as the things you need. Close, but the real explanation is more like this:

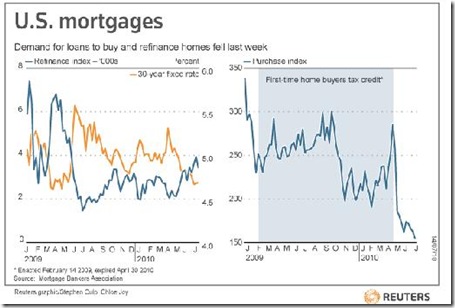

Prices declines are occuring in goods/services sectors backed by debt resulting from contracting credit...things that you would normally use a loan/credit to buy (deflation). Price increases are occurring in goods/services sectors acquired with money resulting from increasing money supply (inflation), (things like food, utilities, gas for the car, etc ).

Ben can print money 'til the cows come home, showering every citizen with $10k, $100k, $1m per year/quarter/month. All that will happen is a direct escalation in prices of assets not backed by debt. Price increases for items backed by debt will not resume/recur until there is an underlying organic demand for credit and a corresponding easing in credit terms (inflation). That is, the so-called final (ie private) demand.

And there you have it...